This heightened activity sometimes precedes major price movements, signaling potential market sentiment or liquidity changes.

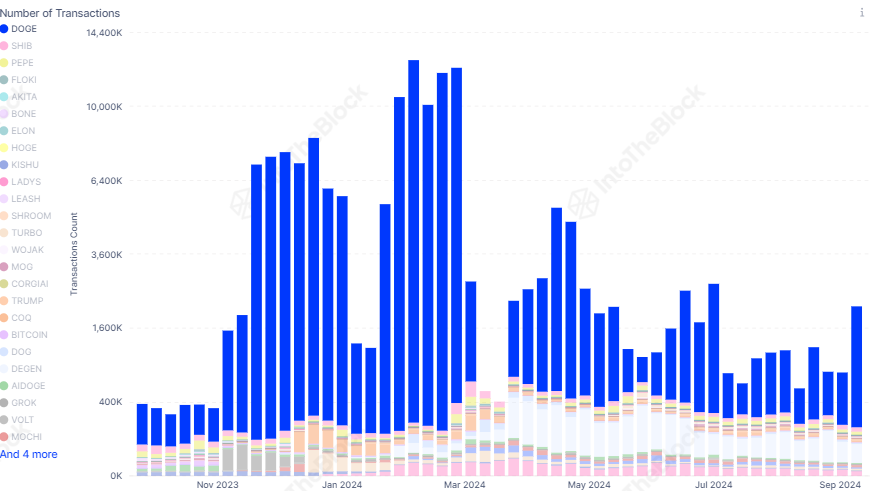

How High Is Dogecoin Transaction Rising?

According to IntoTheBlock, Dogecoin processed 1.93 million transactions last week alone. This figure marks the highest weekly transaction count since early July, suggesting renewed interest and activity within the Dogecoin network.

Although this rise in transaction activity is still below the peak observed in February, it indicates a positive trend that could potentially impact Dogecoin’s market performance. IntoTheBlock noted, “This uptick is a promising sign for the DOGE network.”

So far, this increased transaction activity seems to have already translated into a positive price movement for the asset. Dogecoin has seen a 2.3% increase in the past day, reaching a trading price of $0.1015.This is a notable rebound compared to its price earlier this month when DOGE was trading at $0.09. Interestingly, while the rise in price performance has also boosted DOGE’s market cap, currently at $14.8 billion, the same can’t be said for the asset’s daily trading volume.

Despite the price increase, DOGE’s daily trading volume has seen an opposite trend in recent days, plunging from more than $700 million last week to below $500 million. Regardless, the rise in transaction activity and price suggests a possible shift in market sentiment toward Dogecoin. This renewed activity could signal a resurgence in market interest, possibly laying the groundwork for further price gains shortly.Key Resistance Level to Watch

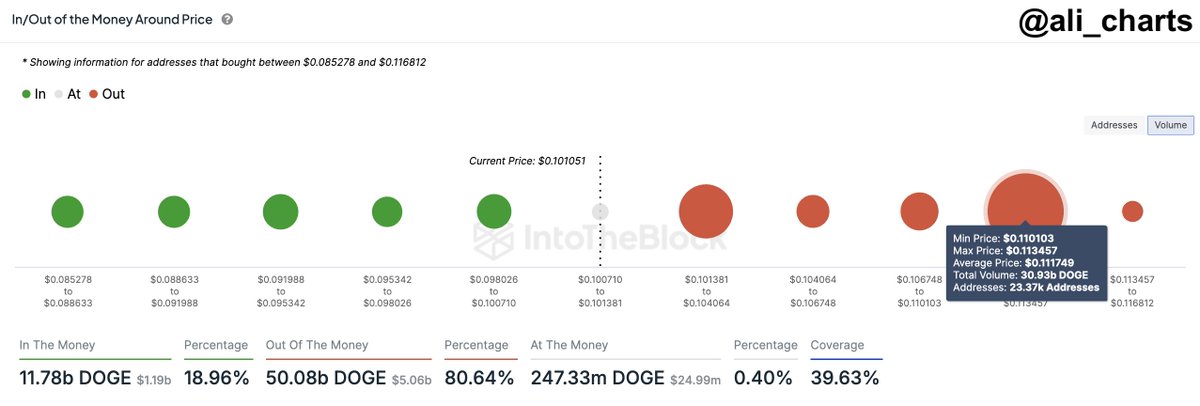

Despite the ongoing positive indicators, Dogecoin faces a crucial test ahead. Prominent crypto analyst Ali recently highlighted in a on X a key resistance level at $0.11 for Dogecoin, where approximately 23,400 addresses are holding around 31 billion DOGE.

According to Ali’s post, should Dogecoin break through this resistance, it could open the door for further upward momentum. However, if it fails to breach this level, it may indicate a period of consolidation or even a possible pullback.

If you’re anticipating a breakout, keep in mind the key resistance level at $0.11, where 23,400 addresses are holding ~31 billion ! — Ali (@ali_charts)Featured image created with DALL-E, Chart from TradingView