Bitcoin price today blasted above $11,000, reviving bullish sentiment across the crypto market. Behind the buzz, is the fact that the leading crypto asset successfully confirmed a bullish retest of $10,000 as resistance turned support.

But at the same time, the future of finance may have also completed a bearish retest and throwback to confirm a bearish reversal pattern. Both directions can’t be right, so which is it? You be the judge.Bitcoin Price Performance: A Head And Shoulders Above The Rest

Throughout most of 2020, Bitcoin and altcoins have been soaring together. But over the last 24 hours, something strange has happened, and the leading cryptocurrency has outperformed alts by a significant variance.

BTC dominance is breaking out of a downtrend line after potentially holding above a key support level and is showing signs of bottoming on high timeframes. If that’s the case, altcoins could be in trouble.

But although Bitcoin is currently looking bullish, rising more than $1,000 from local lows and a critical retest of support turned resistance, price action may have slammed into a brick wall.

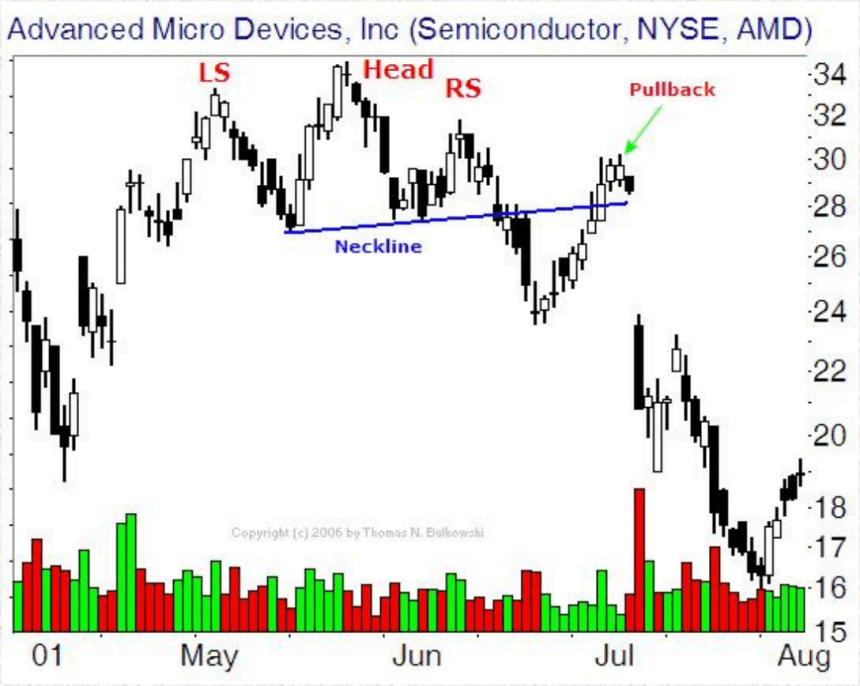

BTCUSD Daily Head and Shoulders Chart Pattern & Throwback | Source:

The potential top pattern – a head and shoulders – that sent Bitcoin price back down to retest $10,000, just had its neckline retested. Thus far, although $11,000 has been holding, the neckline also hasn’t been penetrated and a rejection could be forming.

Head and shoulders patterns, , often experience a throwback to the neckline to keep “trading interesting.” A head and shoulders pattern represents a tug of war between buyers and sellers, with sellers ultimately winning in the end. A throwback stops out late shorters and those two took set a stop loss at the neckline. However, like the example on Bulkowski’s website, throwback can plunge directly through the neckline before falling.

Source:

Bearish Retest, Or Bullish Retest? The Two Sides To Technical Analysis

If the throwback to support turned resistance holds, the pattern could confirm with a deep drop downward through $10,000. Or will it?Related Reading | Bitcoin Reaches 144 Weeks From All-Time High: Why This Number Matters

A throwback to retest support flipped resistance is a bearish retest. However, Bitcoin price may have also recently confirmed the same type of throwback and retest of the multi-year, “meme” triangle downtrend line from all-time high.

BTCUSD Weekly Symmetrical Triangle Chart Pattern & Throwback | Source:This line has acted as the defacto line to beat for bulls, and they did. Now they have to defend their win in order to march forward. The head and shoulders formed on daily timeframes, while the triangle is so large, its visible on weekly, monthly, and higher timeframes.

In technical analysis, more weight is given to the highest timeframe chart patterns. That could suggest that this bullish retest of the triangle, far outpowers the significance of the head and shoulders retest on the daily.

But while it is indeed true high timeframes dominate in TA, reversals are said to start on the lowest timeframes possible. If that’s the case, regardless of what the monthly, weekly, or lower says, it could come down to days, hours, and even minutes between a new bull market, or another bearish breakdown. Which type of retest will win? Bullish or bearish?Featured image from DepositPhotos, Charts from TradingView and The Pattern Site