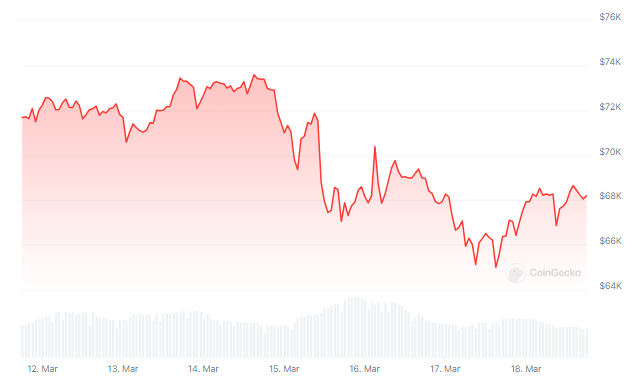

Bitcoin down in the last week. Source:

A Bearish Shadow Looms

According to analysts, investor sentiment has been hurt by a series of descending peaks and failed upturns, while selling pressure remains rampant as we approach the “weekly candle close.” This sentiment is echoed by data from IntoTheBlock, which shows a sharp decline in the number of addresses “In the Money,” signifying a decrease in overall profitability within the Bitcoin network.Source: IntoTheBlock

Finding Support: A Beacon of Hope?

However, not everyone is hitting the panic button. Technical analysis suggests a potential support zone for buyers between $60,000 and $67,000. Popular trader Skew highlights this area as a possible turning point, while also acknowledging significant spot selling from major exchanges like Coinbase and Binance.Spot Market Data Thread, in partnership Binance Spot

Weekend spot buyer hereSpot Supply ($72K – $74K)

Spot Demand ($60K)Interestingly last bounce which was sold into also resulted in a stack of limit bids being quoted lower.

— Skew Δ (@52kskew)

~ Keep an eye on those bids…

Bulls On The Horizon: Are The Giants Awakening?

While the immediate future appears uncertain, some analysts remain bullish on Bitcoin’s long-term prospects. They view the current correction as a natural and healthy part of any bull run, pointing to historical data where similar pullbacks paved the way for further growth.BTCUSD trading at $68,087 on the weekly chart:Thomas Fahrer, CEO of Apollo, a decentralized online cryptocurrency platform renowned for its comprehensive crypto reviews and analysis of ETF inflows, echoes sentiments regarding X. Fahrer characterizes the current state as a “Bear Trap” and pinpoints the resumption of buying from US Bitcoin ETFs on March 18 as a potential catalyst for an upward surge in X’s value.

The Verdict: Brace For A Volatile Week

This week will be crucial for Bitcoin. The coming days will be a test of the cryptocurrency’s resilience and its ability to overcome the current selling pressure. If bulls can regain control and positive sentiment prevails, a return to record highs remains a possibility. However, if the downtrend continues, Bitcoin could face a more extended period of correction.Featured image from Pexels, chart from TradingView

Bitcoin down in the last week. Source:

Bitcoin down in the last week. Source:  Source: IntoTheBlock

Source: IntoTheBlock