#1 Recession Fears Cause Bitcoin Crash

The initial spark for the current market volatility appears to stem from intensifying fears of a US recession, triggered by unexpectedly weak US job market data on Friday. The July report showed a gain of only 114,000 jobs—significantly below the Wall Street prediction of 175,000. This was the weakest job growth since December of the previous year and nearly the lowest since the start of the COVID-19 pandemic in March 2020. Charles Edwards of Capriole Investments via X, “Every single time the unemployment rate turns up as it has today, we have a recession. Just as the Fed was too slow to tighten in 2021, it looks like they were too slow to ease in 2024.”

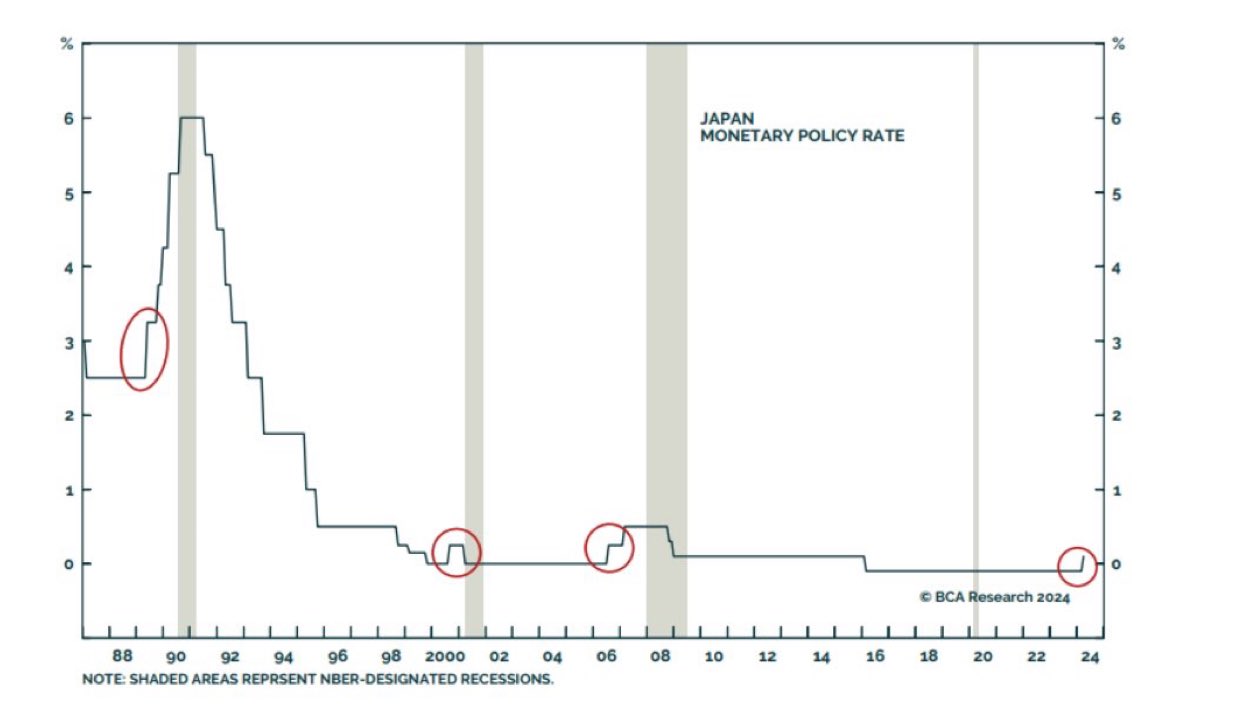

#2 Yen Carry Trade Unwind

Further exacerbating the market’s fall was a significant movement in the forex markets, particularly with the Japanese yen. After the Bank of Japan raised its key interest rate, the yen strengthened considerably against the US dollar. This move pressured traders who had engaged in the “yen carry trade”, borrowing yen at low rates to purchase higher-yielding US assets. Adam Khoo , “The sharp rise in the JPY/USD is causing a massive unwind of yen carry trade positions and contributing to the sharp decline in US stocks.” The reversal of these trades has probably not only impacted the forex and stock markets but also had a cascading effect on Bitcoin and crypto as assets are liquidated to cover losses and repay yen-denominated liabilities.#3 Jump Trading And Large Sellers

There were unusual sell orders recorded across major exchanges such as Kraken, Gemini, and Coinbase, predominantly on a Sunday, which is typically a quieter trading day. This suggests orchestrated actions by large players, potentially involving the unwinding of positions by firms like Jump Trading. Jump Trading has reportedly been involved in substantial unloading of Ethereum, amounting to about $500 million worth over the past two weeks. Market rumors suggest that the company’s sell-off could be a strategic exit from its crypto market-making ventures or an urgent need for liquidity. Ran Neuner commented via X: “I’m watching this selling by Jump Trading […] They are the smartest traders in world, why are they selling so fast on a Sunday with low liquidity? I would imagine they are being liquidated or have an urgent obligation.” Dr. Julian Hosp, CEO of the Cake Group, on X: “The reason for the crazy crypto sell off seems to be Jump Trading, who are either getting margin called in the traditional markets and need liquidity over the weekend, or they are exiting the crypto business due to regulatory reasons (Terra Luna related). The sell-off is relentless atm.” Furthermore, Mike Alfred the possibility of distress within the market, suggesting that a large Japanese fund might have collapsed, holding substantial amounts of Bitcoin and Ethereum. “A big Japanese fund blew up. Unfortunately, it was holding some Bitcoin and Ethereum. Jump and other market makers sensed the distress and exacerbated the move. That’s it. Game over. On to the next one,” Alfred stated.#4 Liquidation Cascade Exacerbates Bitcoin Price Crash

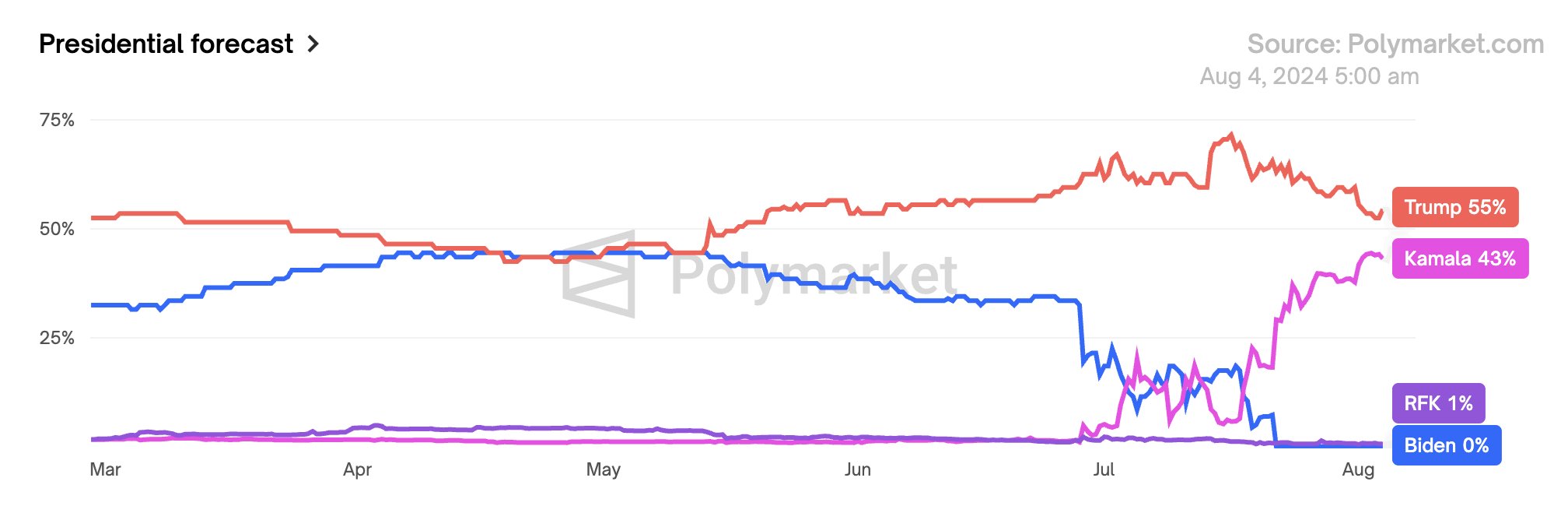

The market witnessed a dramatic increase in liquidations, with CoinGlass reporting that 277,937 traders were liquidated in the last 24 hours, leading to total crypto liquidations of approximately $1.06 billion. The largest single liquidation order, valued at $27 million, occurred on Huobi for a BTC-USD position. In total, $302.07 in Bitcoin longs were liquidated in the last 24 hours, according to CoinGlass . These forced liquidations, driven by margin calls and stop-loss orders, have amplified the downward pressure on cryptocurrency prices, pushing them further into the red.#5 Trump Momentum Fades

Another less significant factor may involve the shifting political landscape, as Kamala Harris gains according to Polymarkets against Donald Trump (Harris 43% vs. Trump 55%). This shift is perceived negatively by the Bitcoin and crypto market. The entire market is favoring a Trump win. He wants to build a “strategic Bitcoin stockpile” and over the weekend said BTC could be used to pay off the US debt of $35 trillion.

#6 Mt. Gox Distributions Still Affecting Market Liquidity

Finally, the ongoing distribution of Bitcoins from the defunct Mt. Gox exchange continues to influence the market. As former users of the exchange receive and potentially sell their returned Bitcoins, this has added to the selling pressure on the market, further depressing prices.

At press time, BTC bounced off the support and recovered to $52,909.