Validating The Bull Flag Pattern: Bitcoin Consolidation Phase Analysis

Bitcoin’s recent dip below $61,000 served as a testing ground for this theory. The cryptocurrency demonstrated resilience by rebounding into the $67,000-$70,000 range, solidifying the potential validity of the bull flag pattern. This consolidation phase is crucial for market participants to reassess their positions and gauge overall investor sentiment.appears to be breaking out of a bull flag on the 4-hour chart! If holds above $70,000, we could see a surge of nearly 10% to a new all-time high of $77,000! — Ali (@ali_charts)The recent dip wasn’t necessarily a cause for alarm, explained Martinez. In fact, it could be interpreted as a healthy consolidation that strengthens the foundation for further growth. Beyond technical analysis, a significant shift in Bitcoin’s ownership structure is fueling optimism. The long-awaited launch of spot Bitcoin Exchange Traded Funds (ETFs) in the United States has opened the door for institutional investors. These professionally managed funds, backed by major financial institutions, are estimated to hold a combined 5% of the total Bitcoin supply.

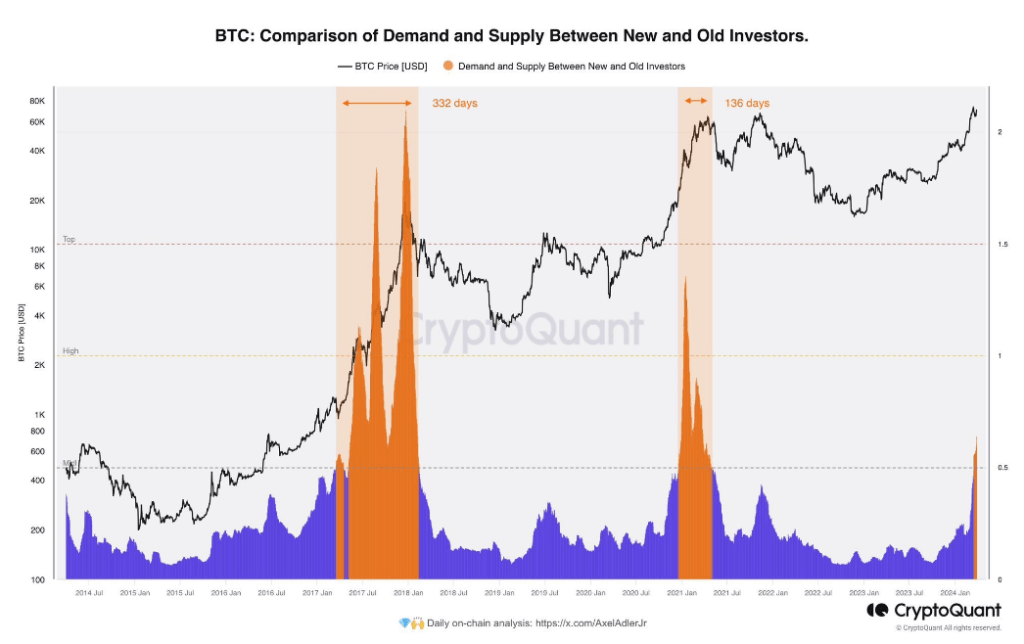

Total crypto market cap is currently at $2.545 trillion. Chart:On-chain data further corroborates this institutional influx. CryptoQuant, a blockchain analytics firm, reports a deviation from past bull cycles. Traditionally, ownership flowed from existing large holders (“whales”) to retail investors. However, the current market cycle appears to be witnessing a transfer from these whales to new whales – traditional financial institutions.

Bitcoin’s Bullish Price Predictions

The influx of institutional capital has emboldened some analysts to make bullish price predictions. While Martinez refrained from offering a specific timeframe for the anticipated breakout above $73,750, others are more forthcoming. Optimistic forecasts range from $100,000 to $150,000 for Bitcoin by the end of 2024, with some even predicting a staggering price of $500,000 by 2025.Related Reading: Fantom: Market Slowdown Chops Off 10% From Gains – Here’s Why

However, experts caution against blindly following such extreme predictions. The cryptocurrency market remains inherently volatile, and technical analysis is not a foolproof method for guaranteeing future price movements. The long-term impact of institutional involvement on market dynamics is also yet to be fully understood. Despite these words of caution, the confluence of a bullish technical pattern and a surge in institutional investment has undeniably created a sense of excitement surrounding Bitcoin. As the world’s leading cryptocurrency continues its ascent towards uncharted territory, all eyes are on whether it can indeed break new ground and establish a new all-time high.Featured image from Pexels, chart from TradingView