Stacks (STX) Climbs Over 60% On Back Of Bitcoin Ascent

Source: CoingeckoStacks bridges this gap by anchoring itself to Bitcoin while offering smart contract features. This innovative approach has garnered significant attention, particularly as Bitcoin itself enjoys a recent price appreciation, at the time of writing. The correlation between Stacks and Bitcoin is undeniable. Both assets saw pronounced recoveries in February’s second week, with STX mirroring Bitcoin’s climb from $38,500 to $50,000. This intertwined fate highlights the influence of Bitcoin’s broader sentiment on Stacks’ price action.

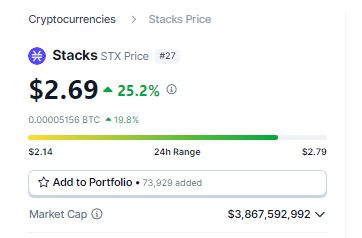

STXUSDT trading at $2.69 the 24-hour chart:

STX Gets Boost On Soaring TVL

Beyond price movements, another bullish indicator emerges from Stacks’ DeFi ecosystem. According to DefiLlama, the total value locked (TVL) within Stacks’ DeFi protocols has surged over 50% in the last three weeks, reaching $70.21 million. This growth signifies rising investor confidence and active capital commitment within the Stacks DeFi landscape. Technical analysis further amplifies the optimistic outlook. Analysts predict a potential continuation of the rally, with price targets ranging from $2.475 to $2.82. This bullish forecast hinges on STX breaching the recent swing high resistance of $2.06, a decisive technical milestone achieved earlier this week.

Stacks Total Value Locked. Source: Defillama

. has gone from around #60 ranked coin market cap to #34 in a year, passing many household names in the same Expect it to enter top 20 around the halving as Bitcoin L2 narratives start dominating the discourse and L1 network fees reach new all-time-highs As we go into… — trevor.btc — b/acc (@TO)However, it’s crucial to acknowledge the inherent volatility of the cryptocurrency market. Recent US inflation data triggered a sell-off across the entire market, reminding investors of the unpredictable nature of this asset class. While Stacks managed to recover rapidly, the episode underscores the importance of responsible investment practices and thorough risk assessment. Despite the risks, Stacks’ unique value proposition and recent momentum cannot be ignored. Its ability to connect the smart contract functionality of Ethereum with the security and immutability of Bitcoin positions it as a potentially disruptive force in the blockchain space.

Featured image from Pexels, chart from TradingView