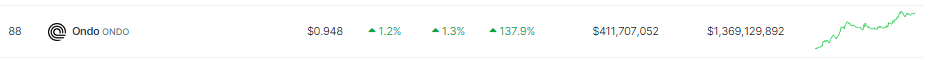

ONDO Marks Banner Week With Big Numbers

Analysts attribute this surge to a confluence of factors. Whale investors, known for their significant holdings and market influence, have been accumulating ONDO at a substantial clip. Data from on-chain tracking platform Lookonchain reveals that three whale wallets recently withdrew over 9 million ONDOs, worth around $9 million, from various exchanges. This behavior suggests a long-term bullish outlook on the token’s potential, potentially inciting a follow-the-leader mentality among retail investors.ONDO doing things right on the weekly chart. Source:

Whales are accumulating token ! Whale”0x56F9″ withdrew 6.53M ($5.88M) from in the past month. Fresh wallet”0x92dD” withdrew 1.98M ($1.78M) from in the past hour. Wallet”0xE6bf” withdrew 937,600 ($845K) from 3 hours ago. Address:… — Lookonchain (@lookonchain)Indeed, Santiment data analyzed by NewsBTC shows a 30% increase in the total number of ONDO holders since March 19th, surpassing the 10,000 mark. This influx of new investors, likely influenced by the whales’ actions and the overall hype surrounding tokenization, has further fueled the token’s price rally.

Total crypto market cap at $2.5 trillion on the daily chart:The recent surge in ONDO’s popularity coincides with a broader trend within the DeFi space. Last week, global investment giant BlackRock announced the creation of a tokenized fund on the Ethereum blockchain, allowing investors to earn US dollar yields through a decentralized platform. This move underscores the growing interest in tokenization, which involves representing real-world assets like securities, currencies, and real estate on a blockchain.

TVL Not Impressive Despite Weekly Rise

However, amidst the celebratory atmosphere surrounding the token’s price surge, a curious detail emerges. Despite the significant increase in ONDO’s value, the platform’s total value locked (TVL), a metric reflecting the total value of crypto assets deposited in its DeFi protocols, has remained relatively stagnant over the past week. While the reasons behind this discrepancy are unclear, it could be a cause for concern for some investors. A stagnant TVL might suggest that the recent price increase isn’t necessarily translating to increased usage of the Ondo Finance protocol itself.Featured image from AlphaTradeZone/Pexels, chart from TradingView

ONDO doing things right on the weekly chart. Source:

ONDO doing things right on the weekly chart. Source: