The Reasons For The Bitcoin Plunge

Analyst @52Skew presumably shared the initial trigger for the sudden drop in Bitcoin price via Twitter. The trader revealed that 16,000 Bitcoin were sold off from Binance spot at the market price, while “pretty typical” amounts were sold off on other spot exchanges. “Interesting selloff here,” the analyst remarked in reference to possible activity by whales.

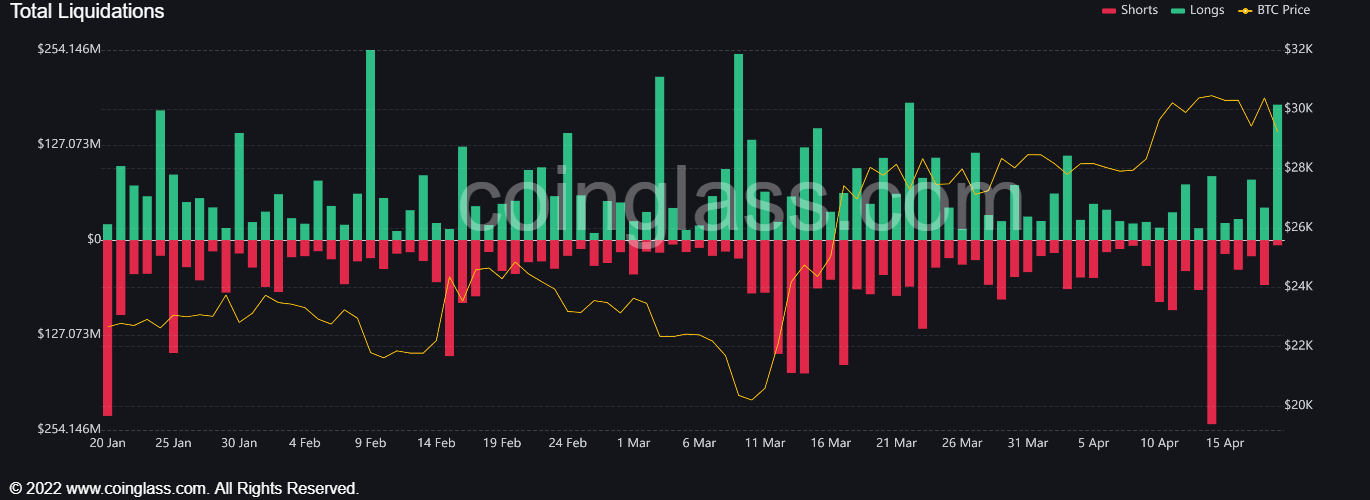

Indicators investors should look out for, according to @52Skew, are negative funding “across the board”, open interest, which indicates a large interest in shorts, and an elevated spot buying volume. After the huge sell-off, a so-called long squeeze on the futures market occurred. More than $181 million worth of Bitcoin futures were liquidated according to Coinglass data. This marks the highest amount of long liquidations since March 9 and March 23 this year.Either a new local low here if $29K is held & no FUD is dropped later. However, 16K BTC is unusual size to be market sold solely from Binance spot. Usually this kind of sale happens before bad news comes out. If a nothing burger event; could see an omega short squeeze.

At press time, the Bitcoin price was trading at a key support level, changing hands for $29,166.‘Should you get into #altcoins and positions?’ Well, this drawdown is your chance. Bitcoin corrects, cascade of liquidity being taken on altcoins and deep wicks providing significant opportunities. Nothing major has changed, just a correction.